Stocks or Real Estate?

Eric Beise | Realtor

Countless articles have been written promoting the benefits of stocks over real estate or real estate over stocks. While there is certainly merit in weighing the pros and cons of these two options for investment, the reality is that most Americans nearing retirement could use more of any financial asset! The ultimate question is not what rate of return you earn but what rate of saving you are able to attain during your working career.

With this in mind, we pose the following question: what impact could three years of house hacking have on the net worth of someone approaching retirement? (If you aren’t familiar with house hacking, please read this post).

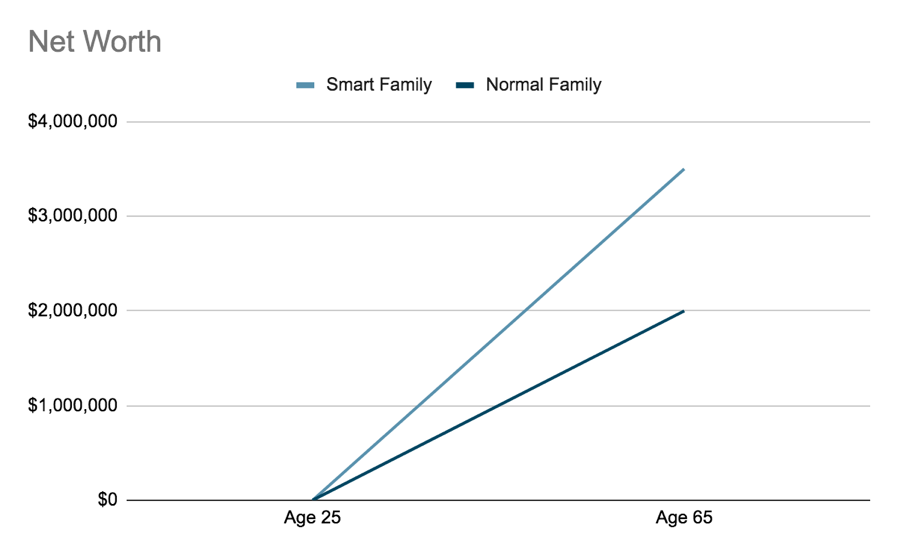

In scenario A, we have Nick and Nancy Normal. They choose the average American route of buying their first home a few years out of college. By age 25, they begin to contribute 7% – the average amount – of their salaries into 401(k)s or Roth IRAs throughout their working careers. With their combined household income of $100,000 per year, this means they are investing $7,000 per year. With an assumed 7% rate of return this amounts to almost $1,500,000 at retirement. Their single family they bought for $250,000 is now worth over $500,000 bringing their total net worth to about $2,000,000. Not too bad! In combination with Social Security, this should set them up for a comfortable retirement.

By comparison, Sam and Sally Smart choose to purchase a duplex as their first home. They live in it for three years before moving out and purchasing a single family home of their own. The cash flow from the duplex enables them to save 12% of their income during their working careers while spending the same amount on living expenses as Nick and Nancy. Assuming a 7% rate of return on their investments, their investment portfolio is worth over $2,500,000. Not only this, but they also have both a paid off home and a paid off duplex totalling over $1,000,000 in value. This brings their net worth to approximately $3,500,000.

Three years of living in a duplex and a few decades of occasionally checking in with a property manager result in a $1,500,000 increase in net worth at retirement! Alternatively, this could mean retiring about a decade sooner.

I realize this thought exercise is grossly over simplistic, but it is meant to convey a somewhat accurate picture of reality. If anything, the actual net worth bump of owning one property is likely much greater. We have conveniently ignored the realities of depreciation/tax benefits of rental properties, rising rents that increase cash flow over time, and the 10 years of owning a fully paid off property before retirement. The actual result would probably be at least doubling the net worth of someone taking the “normal” path.

The question is not stocks or real estate. The question is how to best free up dollars for investing. At that point whether you can earn your 7% return from stocks, bonds, real estate, private businesses, or anything else doesn’t really matter. The challenge is that there are only two options available for freeing up dollars to invest: increasing income or decreasing expenses. Most people would of course prefer increasing income! Buying an income producing asset at the outset of your career is one of the easiest ways to accomplish this. Who knows, you may just double your net worth with one property.

Keep up with Wits

More from the Wits Blog:

House Hacking: Mindset

By: Eric Beise | Realtor In House Hacking Part 1, we uncovered some of the ways you can integrate house hacking into your lifestyle. As we start digging deeper, one concept stands out as being the most effective way to think about house hacking. It’s the linchpin of the strategy, and the more you buy…