Twin Cities Real Estate and COVID-19

By: Eric Beise | Realtor

With growing fears regarding COVID-19 and its impact on the economy, we wanted to provide you with information that may ease your concerns. By extracting data from past pandemics and economic recessions, we presume that in the midst of this fear and chaos, the outlook of the housing market looks relatively positive.

Every pandemic affects the economy differently, and therefore, we must be careful with the conclusions we’re drawing from the data. However, SARS is a paralleled pandemic example for us to reference. In this case, overall house pricing didn’t change significantly. There was a change in behavior during the pandemic, but this reverted back to normal when social distancing was no longer enforced. In this case, the impact of the pandemic on the housing market was minimal.

Despite this positive outlook, many Americans are still concerned about repeating the 2008 recession. Before addressing that particular recession, let’s look back to 1980. Since that year, there have been five official recessions. If we exclude that of 2008, housing prices have only decreased by 2.7% from the month before the recession started until the month after it was finished. In comparison, the recession in 2008 experienced a 33% drop in housing prices. While that is extreme, the current status of the economy compared to that of 2008 leads us to believe the effect of COVID-19 on the market will not be as detrimental. Let’s take a look at 4 key indicators.

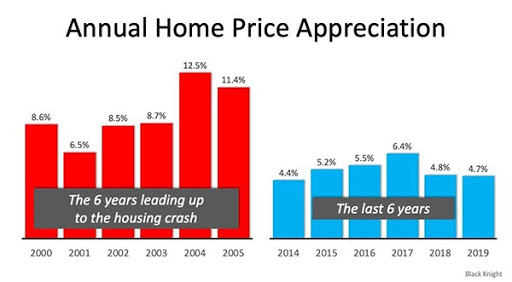

1. Healthy Appreciation

Although we cannot be certain, we don’t anticipate the same effect on the housing market as in 2008. First, observing the average appreciation of homes six years leading up to the recession in 2008, we see an appreciation of 9%. However, we’re currently averaging 5% appreciation in the past six years, which is considered the normal rate for a stable economic market.

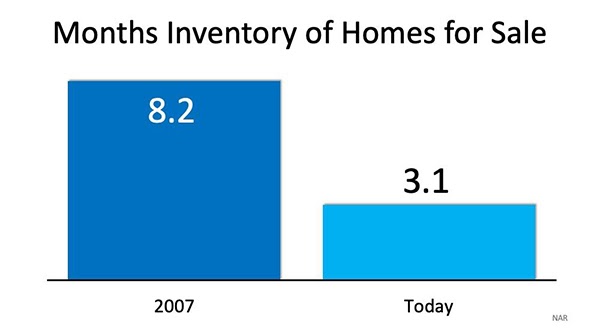

2. Low Inventory

Second, while we’re currently at a deficit for home inventory at 3.1 months of inventory, this is significantly lower than that of 2008. Leading up to 2008, we had 8.2 months of house inventory. Most people claim 4-6 months of home inventory is market equilibrium. Even though we are not currently within this range, the current state is still closer than that of 2008.

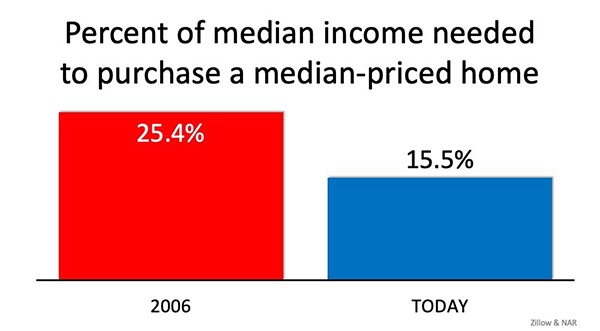

3. Stronger Borrowers

Next, we anticipate the difference in borrowers from 2008 to today’s economy to make an incredible difference in the stability of the housing market. In 2006, 25% of a borrower’s median income was needed to purchase a medium-priced home. Whereas today, it is 15.5%. In other words, consumers are buying well within their means. In addition, people have a harder time building credit, meaning borrowers are more well-qualified for their loans. Leading up to the 2008 crash, borrowers were being granted loans they truly shouldn’t have been given based on their credit history. With borrowers having well-qualified loans, we anticipate they will be more likely to repay the loans without consequence.

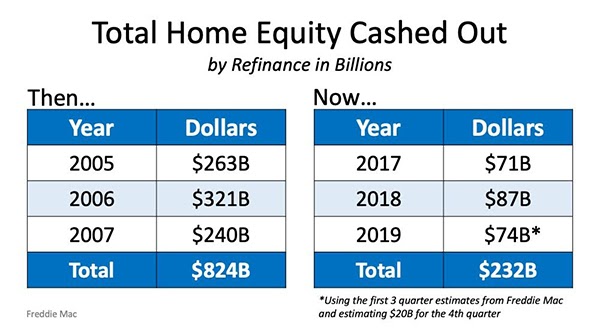

4. Less Leveraged

Finally, not only are borrowers more qualified as an American home-owning household, we are not using our homes as refinancing machines as we did previously. In 2005, 2006, and 2007, the total number of dollars that we took out of equity through cash-out refinances was $824 billion. In perspective, in 2017, 2018, and 2019, we’ve only taken out $232 for refinancing. Compared to the times leading up to 2008, there’s a lot more equity in homes right now.

Summary

Overall, we understand and hear your concerns regarding COVID-19. We want to ease your fears by providing you with helpful information to move forward. This historical data makes this outlook look more positive than what you might be feeling in the heat of this stress. We can use this foundation to stand on as we maneuver through these unsettling times.

Keep up with Wits

More from the Wits Blog:

Real Estate Investing: The Path of Progress

It’s an age-old mantra of the wise real estate investor and no one will dispute that location is key for any long-term real estate investing strategy. The differing of opinions start flying when we talk about what goal the location is going to accomplish.